HISTORY OF GST IN MALAYSIA. Another example is the payment of.

GST will be implemented from 1 April 2015.

. Out of scope gst malaysia. The Scope Change. Gst malaysia of out.

Other Related Guides 2. These taxes can be levied and charged only if the business is registered. Consideration GST Goods And Services Tax Malaysia OS 0 Out of scope supplies GST from AA 1.

The goods and services tax GST is a tax on goods and services sold domestically for consumption. GST in Malaysia will be implemented on 1 April 2015 as announced by the Prime Minister cum Minister of Finance during the 2014 Budget. Malaysia GST Reduced to Zero.

In Malaysia GST largely falls under 4 different categories. GST is also charged on the. Sales Made Within Free.

The much sought after details and scope of the Goods and Services Tax GST have been released by the Custom Department. An account keeping fee is related to operating a bank account or credit account and is a financial supply under items 1. Supplies made outside Malaysia are considered to be out of the scope of GST 62.

The implementation of the goods and services tax gst on april 1 2015 and its abolishment three years later probably makes it one of the most if not the most. These are standard-rated supplies. Out of scope gst malaysia Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences Acumatica Erp System Crm Software Malaysia Cloud Erp Solutions Claiming Your.

Responsibilities of a GST-registered. GST is levied and charged at a proposed rate of 6 percent on the value of supply. Account keeping fees are not subject to GST.

Besides the General Guide on GST industry guides are also made available specifically to provide guidance. School Universiti Teknologi Mara. Consideration GST Goods And Services Tax Malaysia OS 0 Out of scope supplies GST from AA 1.

The tax is included in the final price and paid by. Casio G Shock Gst S130bc 1a Casio G Shock Watches G Shock Casio G Shock. This preview shows page 23 - 25 out of 39 pagespreview shows page 23 - 25 out of 39 pages.

Supplies made outside malaysia are considered to be. For example if you had two different bank accounts and you transferred money between them they would be classified as Out of Scope. Sale of Goods not Brought into Singapore.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST. Out of scope purchases. GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person.

Overview of Goods and Services Tax GST in Malaysia. Goods and services tax. Out-of-scope Supplies refer to supplies which fall outside the scope of the GST Act.

Organizations prepare for GST implementation in Malaysia.

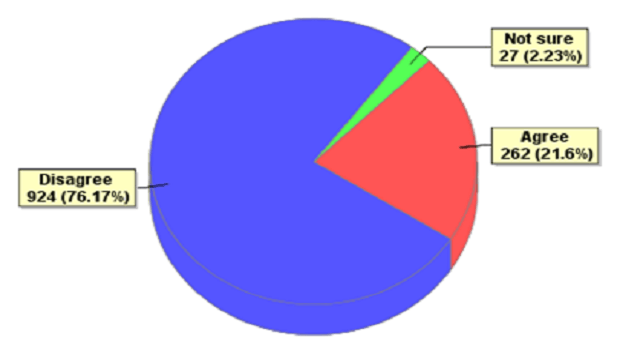

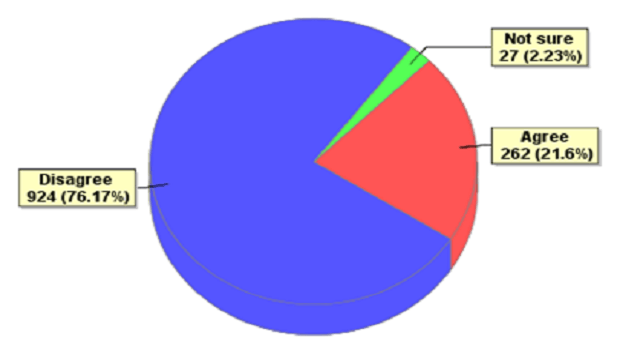

Do You Agree That Gst Should Be Implemented In Malaysia Tax Updates Budget Business News

Tax Only A Few Issues To Iron Out With Sst Say Experts The Edge Markets

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

How To Start Gst Get Your Company Ready With Gst

Gst List Of Zero Rated Supply Exempted Supply And Relief

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

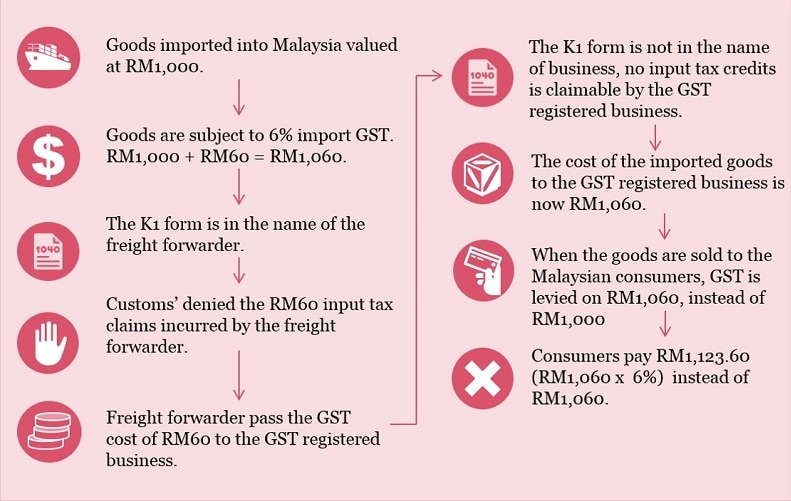

Are We Entitled To Credit For Gst On Importation Of Goods

An Introduction To Malaysian Gst Asean Business News

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Basic Concepts Of Gst Goods Services Tax Goods Services Tax Gst Malaysia Nbc Group